First-time Homebuyer's Guide: Applying for your first mortgage

You’ve dreamed, you’ve planned, you’ve budgeted, and you’ve finally found that place you want to call home. Now, you just need to pay for it.

Getting a mortgage isn’t always easy but, the more you understand about the process, the smoother it will go. Here’s a rundown of what to expect:

Know your numbers

Before you start the application process, make sure you understand what lenders are looking for and how to meet their requirements. If you’ve taken the time to improve your credit score, decrease your debt-to-income ratio, and save for your down payment, you should be in good shape. Now is a great time to review everything so that you’re confident about your financial picture going into the mortgage process.

As we’ve mentioned before, the time leading up to applying for your mortgage is not the best time for new credit inquiries, major purchases or transfers, or job changes. If possible, wait until your mortgage is funded and the keys to your new home are in your hand before you make any financial moves. Your lender is required to re-verify your finances right before finalizing your mortgage, so let them know of any changes immediately to help avoid any last-minute surprises.

Gather documents

Remember, in order to provide you with a loan, lenders will be looking for proof that you’ll be able pay both now and later — and they can’t just take your word for it.

Start gathering your financial documents now, including:

- 2 years of personal tax returns

- 2 years of business tax returns (if you own more than 25% of the business)

- 2 years of W-2s or 1099s

- 2 months of bank statements

- Proof of any alimony or child support payments

If you’re applying with Better.com, you’ll be able to link your bank accounts and upload your documents digitally. As our underwriting team reviews your initial application, we’ll let you know what follow-up documents we need based on your specific financial situation.

Get your Verified Pre-Approval Letter

Once you have your documents gathered and you’re ready to start shopping for a home, you’ll be able to get our Verified Pre-Approval Letter. It’s common for real estate agents and sellers to request a pre-approval letter from potential home buyers. They’re looking for certainty — they want to be certain that the number you say you can afford is what you’ll actually get approved for when you apply for a loan. That’s why a cash buyer is so attractive to them — they know the money is in the bank. That’s why our Verified Pre-Approval Letter is so helpful. It involves both you and us taking a bit of extra effort up front to actually verify your financial details so that we can tell you exactly how much you’re qualified to borrow. Essentially, it can give you the certainty and confidence of a cash buyer.

To get you verified, we’ll need documents like your recent pay stubs, tax returns, and W-2 forms. We’ll also need to perform a credit check. Once you’ve applied, we can provide a 100% digital, underwriter-reviewed letter for qualified borrowers. It’s a completely free service, and there are no strings attached. The best part? Once your offer is accepted and you’re ready to apply for a loan, our underwriters have already done most of the work verifying your financial details. That means we can usually close your loan weeks faster than the industry average*, often within 14 days from locking your rate.

Lock your rate

Once you have the purchase contract for your new home and you’re ready to lock your rate, we’ll get started by asking for your $550 appraisal fee (and $325 HOA fee, if applicable). If either fee turns out to cost less than what we’ve asked for, we’ll refund you the difference. If for some reason your loan is denied, or the seller backs out, we will refund you in full.

Submit documents

Next, we’ll have you upload your financial documents. We’ll also need you to provide a home insurance quote. The great news is if you’ve already gotten a Verified Pre-Approval Letter with us, we already have most of the information we need.

YOUR MONTHLY MORTGAGE PAYMENT

Your monthly mortgage payment, sometimes referred to as “PITI,” consists of four components: principal, interest, taxes, and insurance.

Principal

This is money going toward the actual balance of your loan. As time goes by, you’ll pay more toward your principal and less toward interest.

Interest

This is money going toward paying interest on your loan. As time goes by, you’ll pay less interest and more toward your principal.

Taxes

Property or real estate taxes are determined locally, and vary from area to area. Tax rates can be quite high in certain areas, so it’s a good idea to research rates in advance as they can add significantly to your monthly payment.

Insurance

Insurance can include homeowners insurance (which you’ll need to purchase after your offer has been accepted and before your loan is closed) as well as private mortgage insurance (PMI), which is typically required if you put less than 20% down.

HOW DOES AN ESCROW ACCOUNT WORK FOR MORTGAGE PAYMENTS?

Taxes and insurance aren’t always due on a monthly basis, but you can still choose to pay them monthly by setting up an escrow account (for some loans, an escrow account will be required). If you have an escrow account, you’ll pay one-twelfth of your yearly insurance and taxes each month, and your payments will automatically be made from that account when they are due.

THE OTHER ESCROW ACCOUNT

A different escrow account is also used during closing. It is an account managed by a third party (sometimes called a “closing agent” or “escrow agent”) where the funds you are using to pay for your home are kept safe until the loan is finalized and the deed to your home is in your hands.

Closing costs and how to lender shop

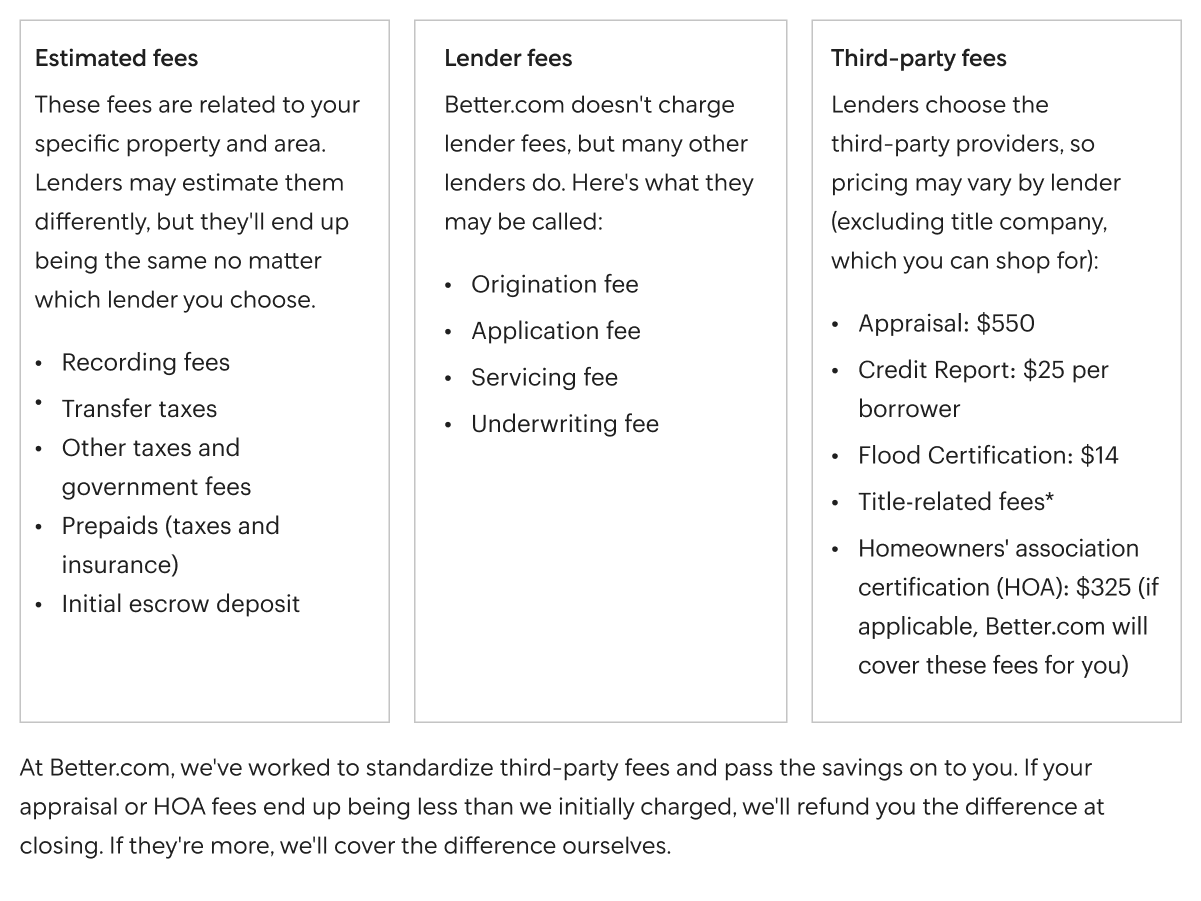

When it comes to shopping for the best mortgage, rates and the costs associated with them (i.e. “points”) aren’t the only factors to consider. This post offers a more detailed overview about what goes into the price of your mortgage and how to compare lender offers. Let’s look at the additional closing costs you should be prepared to pay. Some fees vary between lenders, while others will be the same no matter who you work with. To compare offers, you can ask the lenders you are talking to for a Loan Estimate, which is a standard document created by the Consumer Finance Protection Bureau. Here’s a breakdown:

Common fees

Follow-ups and property-related tasks

You’ll be assigned a Processing Expert, who will work with you to answer questions and make sure we have all the documents we need. You can also log in at any time to see what information we still need from you. In the meantime, we’ll start working on property-related tasks like your title, appraisal, and HOA questionnaire (if applicable).

Underwriting your loan

Once we have what we need from you, our underwriting team works to review everything, typically in 3 days or less. During this time, your Processing Expert may follow up with you about any additional information needed. They’ll also be working to make sure all property-related tasks are completed. Before finalizing the underwriting process, we’ll ask you to pay for homeowners insurance and confirm with us.

Final approval

Once all the final documentation is in, we perform some final checks to make sure absolutely everything is in order.

Closing and funding

Once your loan is finalized, we’ll send over the closing disclosures for you to review (which includes the final third-party costs, down payment, and prepaid costs). We’ll work with you to schedule the closing and get all the necessary documents signed.

Questions? That’s what we’re here for.

We know this stuff is complicated, so please don’t be shy about asking for the information you need. Feel free to schedule a call with us anytime, for any reason.

Next up? First-time Homebuyers Guide: How to think like a mortgage lender.

* Better.com has preferred title companies who have competitive pricing and can typically deliver on our faster turnaround times. However, if you are able to find a cheaper provider, we’re happy to use them.